Cash Deposit Ratio Formula

Extending the cash turnover ratio by dividing 365 by the CTR provides the number of days on average that it takes for a company to replenish its cash balance. Cash Ratio Formula.

Cash ratio is calculated by adding the companys total cash reserves and cash equivalents marketable securities and dividing this amount by its current liabilities.

. Additional Reserve Requirement 55 45 200 million. Cash-Deposit Ratio cash in hand balances with RBIAggregate Deposits Demand Time Deposits So Cash Deposit Ratio is a measure of cashless economy. Ad Open a Compound Interest Savings Account Today Earn as High as 500 Interest.

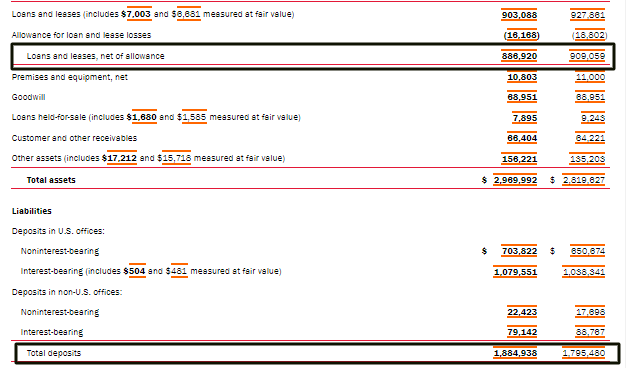

To calculate the loan-to-deposit ratio divide a banks total amount of loans by the total amount of deposits for the same period. LDR Total Loans Total Deposits To calculate the ratio we take the total loans and divide them by the. Additional Reserve Requirement New Cash Reserve Ratio Old Cash Reserve Ratio Bank Deposits.

Determine the cash reserve requirement of the bank for the year 2018. Bank deposits 138148 billion. Typically the ideal loan-to-deposit ratio is.

Given reserve ratio 10. The formula is as follows. Let us understand the.

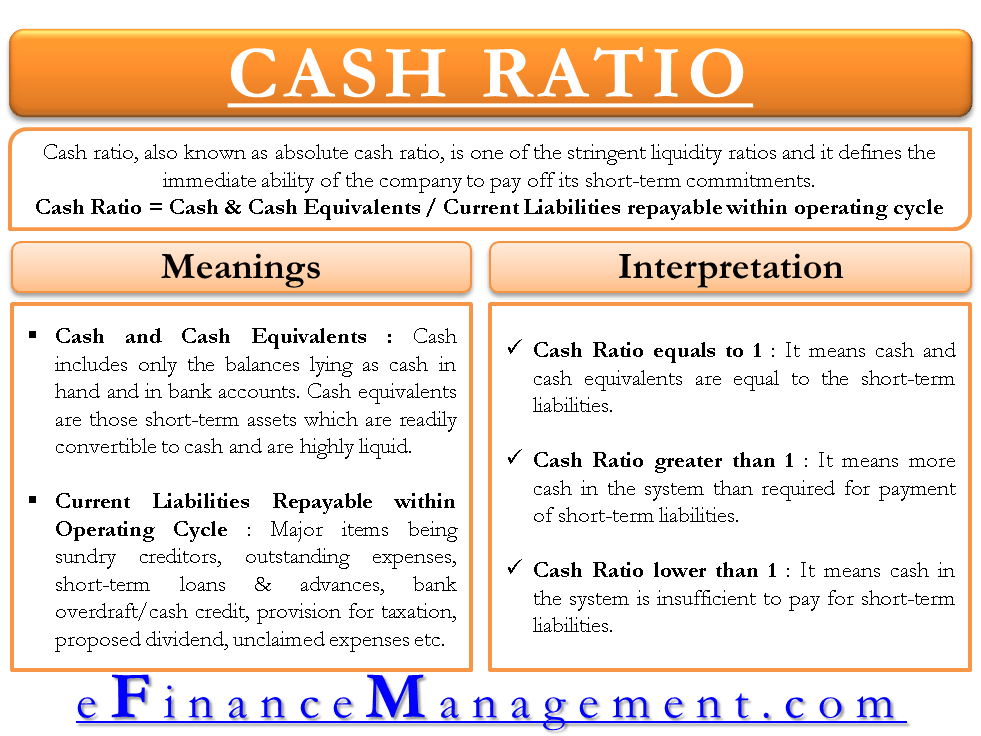

Cash Ratio Cash Cash Equivalents Total Current Liabilities. Time liabilities like fixed deposits FDs. The Ratio of Currency to Deposit Sapling.

The Formula for Cash Ratio is. How to Calculate Cash Ratio. If if has a cash ratio of 1 it will need to hold.

Cash Ratio Cash and Cash Equivalent Current Liabilities. If you have a 500000 portfolio get this must-read guide by Fisher Investments. Demand liabilities like demand drafts DDs current deposits cash certificates and so on.

To compute the quick ratio cash is added to cash equivalents demand deposit and marketable securities as well as receivables then divided by your current. The formula for calculating the loan to deposit ratio is as follows. Therefore the reserve to be maintained by Bank of.

Ad This guide may help you avoid regret from making certain financial decisions. Definition of Cash Ratio The ratio of cash to total liabilities a bank will hold. The amount of money a bank should have available as a percentage of the total amount of money its.

Cash Asset Ratio Cash Cash. Compare Compound Interest Savings Accounts by APY Fees and Deposit Requirements. For example suppose that a bank has deposit of 100 billion.

Typically a banks liabilities are as follows. Cash ratio formula The cash ratio equals the cash and cash equivalents total divided by the current liabilities total. The cash asset ratio is calculated by dividing the sum of cash and cash equivalents by current liabilities.

Cash deposit ratio definition. Quick Ratio Formula.

Reserve Ratio Formula Calculator Example With Excel Template

Cash Ratio Define Formula Calculation Interpretation 1 1 1

7 24 Ie Ss What Is Currency Deposit Ratio Definition Of Currency Deposit Ratio Currency Deposit Ra Youtube

How To Calculate The Loan To Deposit Ratio With Average Ldr Of The Big Banks

:max_bytes(150000):strip_icc()/dotdash_Final_Reserve_Ratio_Definition_Oct_2020-01-abeb9a9e7e894fddbbbf82dc746152f5.jpg)

No comments for "Cash Deposit Ratio Formula"

Post a Comment